ANNUAL FUND

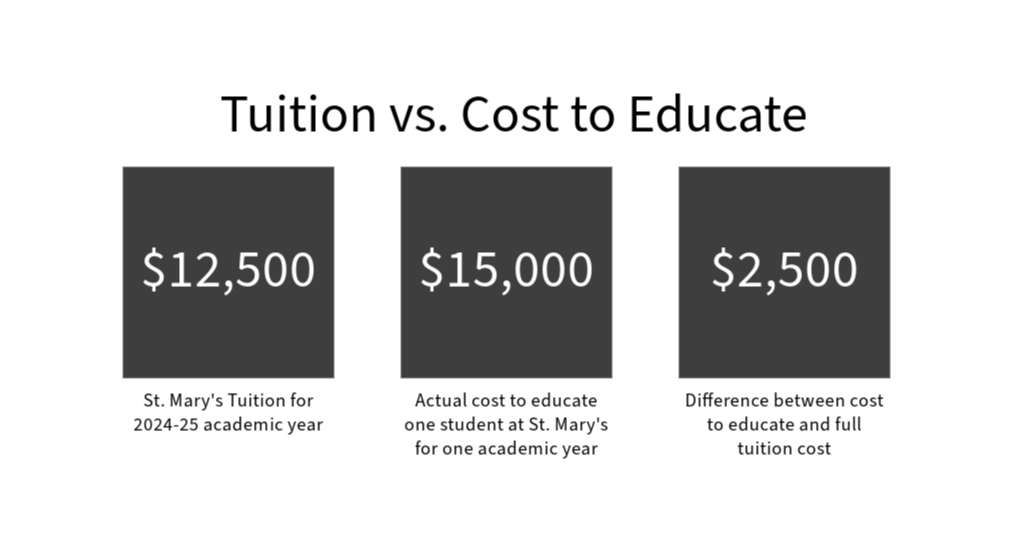

The Annual Fund provides the critical dollars used to cover the difference between tuition and the actual cost of educating St. Mary's students. Each year, St. Mary's alumni, parents, faculty/staff, and friends impact the lives of St. Mary's students with a gift to the Annual Fund.

These Annual Fund dollars are used in many different ways. Here is how your Annual Fund investment helps St. Mary's:

A St. Mary's High School education is a priceless investment in a young person's future. We want to enable every deserving young person, regardless of financial circumstance, the opportunity to receive a St. Mary's education.

For the 2025-2026 school year, more than 70% of students are receiving some amount of assistance. The average amount granted is approximately $3,300.

Provides need-based tuition assistance to students and their families.

Conducts critical building improvements.

Secures vital equipment for student use.

Provides overall support of our operating budget.

Creates opportunities for extra-curricular participation.

No matter the amount of the gift, your investment in the Annual Fund enables current students to receive an education that will last them a lifetime.

"STUDENTS FIRST" INITIATIVE

One of the goals of St. Mary's High School is the desire to admit any academically qualified young man or woman, regardless of the economic reality of the student's family.

Our "Students First" initiative matches an individual's or a group's passion for directly assisting young men and women who need some extra economic support to attend St. Mary's. "Students First" donors make a real impact on a student's years at St. Mary's with a four year pledge ranging from $2,000 up to the equivalent of full tuition per year. Your gift can be a four year commitment for a student's time at St. Mary's.

On average, more than 70% of our young men and women receive tuition assistance to attend St. Mary's High School.

$12,500 sponsors a St. Mary's student receiving 100% tuition assistance

$6,250 sponsors a student for 50% of the school year

$3,125 sponsors a student receiving 25% tuition assistance

$2,000 minimum gift

ST. MARY'S CATHOLIC EDUCATION FOUNDATION

The St. Mary's Catholic Education Foundation (SMCEF, a 501c3 non-profit organization) exists to support the mission of St. Mary's High School by allowing benefactors to make sustaining gifts to the school through a variety of endowed funds. For a full list of these funds, see our Endowments page.

PLANNED GIVING

There are many creative giving opportunities that can significantly benefit the donor and St. Mary's or the Foundation. The School has a wide array of resources available to support donors in this process and encourages inquiries from donors and their advisors.

Listed below are some of the gifting instruments that allow you to support both your family and St. Mary's High School.

GIFTS OF SECURITIES

You may use stocks and securities to make a gift to St. Mary's. If the securities have appreciated, you may find that you can make a larger gift at a lower cost than if the gift were made in cash. Stock in companies that are closely held may also be given to St. Mary's. Independent appraisals of market value must be obtained to determine the value of closely-held securities at the time of giving.

GIFTS OF CASH

Cash gifts are generally tax deductible in the year the gift is given. Checks should be made out to St. Mary’s High School and mailed to the Development Office, 2501 East Yampa Street, Colorado Springs, CO 80909. St. Mary's can also receive gifts via credit card by calling the business office at 719.635.7540 ext 15 or by donating online (see GIVE NOW! box at top of this page).

GIFTS OF PROPERTY

Property gifts include real estate and tangible personal property such as antiques, art, collections, and the like. When such gifts support the function and purpose of St. Mary's, they can be important contributions to the school. Donors should consult St. Mary's Development Office before they make gifts of tangible personal property to St. Mary's, since such gifts come under more rigorous scrutiny by the Internal Revenue Service.

BEQUESTS AND TESTAMENTARY TRUSTS

Gifts made through your will can be made to St. Mary's either through a new document or a codicil to an existing will. Gifts through bequests can help reduce federal estate tax liability. To include St. Mary's in your will, you should instruct your attorney to designate one of the following:

A specified cash amount;

A specific property;

A percentage of your estate;

Remaining assets after loved ones are provided for.

CHARITABLE TRUSTS AND LIFE INCOME PLANS

Trust agreements are individually written to accommodate the donor’s wishes with respect to a gift to the School while still taking care of family financial concerns. St. Mary's Development Office can help you make a decision regarding these specialized financial plans, and you are urged to discuss them with your attorney or financial advisor as well.

CHARITABLE LEAD TRUSTS

This trust is created when a donor places property or cash in trust along with the income generated and dedicates it to St. Mary's for a period of time. The assets placed in trust revert to the donor or his or her heirs at the end of the time period. The trust creates an immediate tax deduction in the year the trust is created, and it often enables the donor to pass assets to his or her heirs, usually with beneficial estate tax consequences.

CHARITABLE REMAINDER TRUSTS

A charitable remainder trust is created when a donor places property or cash in trust along with the income generated and dedicates it to the donor or his or her heirs for a period of time. The assets placed in trust go to St. Mary's at the end of the time period. The trust creates an immediate tax deduction in the year the trust is created, and it often enables the donor to pass assets to his or her heirs, usually with beneficial estate tax consequences.

LIFE INSURANCE

St. Mary's High School can be a total or partial beneficiary of an existing whole life insurance policy, or a new policy may be taken out for this purpose. Life insurance can also be used to replace the monetary value of assets used for charitable gifts made from your estate. Annuities may also be given to the School.

REMAINDER INTEREST IN A PERSONAL RESIDENCE

You may retain a life interest in your home or farm while deeding the property to the School. Though you may continue to live in or use the property, you may claim a tax deduction at the time the property is transferred.

RETIREMENT PLANS

Donors who wish to make a bequest to St. Mary's should consider naming the school as a direct beneficiary of all or a percentage of the assets left in their retirement plans. These assets passing to SMHS will escape both the estate tax and income tax, though they may be subject to the excess accumulation tax if the plan is sufficiently large.